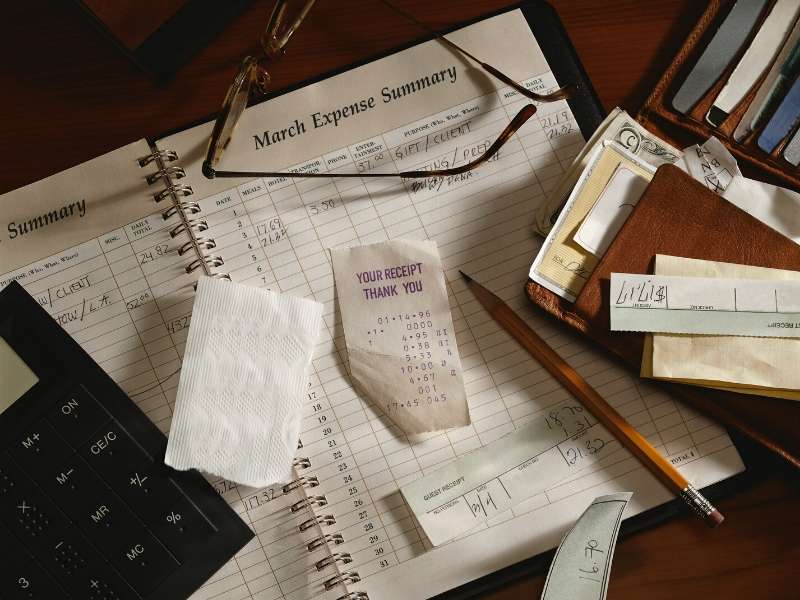

Budget to Help Organize Finances

What is a family budget?

A family spending plan is a set of guidelines or laid-out-in-advance treatments which work as a guide to paying your bills, acquiring points members of the family requirement, putting aside some cash as cost savings, and so on etc. No one in your household need to spend any type of money, outside of an outright emergency situation, whenever doing so would certainly trigger the house to discuss the household budget.

The family budget plan informs you your economic spending as well as usage restrictions for an offered period of time, generally for one month that based upon the following:

- Your household’s overall earnings,

- your financial debt tons (consisting of taxes),.

- your regularly happening costs such as your power or phone costs the way of living you wish to keep or recognize.

All household budgets are planned to aid you understand your objectives and take care of all immediate demands, such as food, for yourself and your household while at the same time obtaining your house to make more money than it spends.

What makes a family budget plan effective?

The keystone of a successful household budget plan, or any spending plan, is by seeing to it that even more money is generated than goes out. You can not realize your financial goals as well as way of life dreams if you and also your family members are spending money that you do not have. If you are staying in financial obligation, you need to ensure that your household revenue is above your usage costs each week, month, or yearly quarter. One of the most important goal of developing the family members budget plan is to obtain out of financial debt, as well as to do so as fast as feasible.

How does creating and then preserving a reliable household budget work?

Everything starts with preparation and also thinking ahead. The word economics literally suggests “household administration” in its Greek root. Aside from ensuring all the people in your home gets along halfway decent, the monetary part of home administration is one of the most integral part.

You should draw up a strategy of expenditures as well as you need to follow it. If you do it right, you need to be able to keep your present lifestyle, as well as have sufficient cash for recreation and leisure (which are very important to psychological and psychological health and wellness). However, preserving this spending plan can mean altering specific spending routines. If that’s the case, you and all your family members that are functioning will require to comply with the household budget plan.

At the very least for a lot of us, money is limited. This means you need to prioritize exactly how you spend your money. When the majority of your prompt needs are cared for, your family budget plan will certainly direct you to pay down your most important or outstanding debts first. For the large bulk of individuals, this will be their home loan or bank card financial obligation.

Pay Yourself First.

Producing a family spending plan, however, also services the concept of “paying yourself first”. This indicates that you deposit as much money as your budget plan permits towards financial savings and financial investments. Your “investments” may be a money market account, CD at your financial institution, or it may be some stock investments made with the assistance of a monetary specialist. But anyway, you need to make certain that you take several of your income off the top prior to you get down to business of paying the grocery store for your food and afterwards paying the bank for your home loan.

A Home Budgeting Tool that Functions.

United First Financial has an exclusive software application called the cash Merge Account This special software program is created to aid you calculate with pinpoint accuracy exactly how to stabilize your home finances to achieve the optimal financial obligation pay for per duration while still satisfying every one of your household’s economic dreams and objectives. The Money Merge Account is an unbelievable tool that any person serious regarding home budgeting should consider.

For more information, kindly see here now to learn more.